What is a DST?

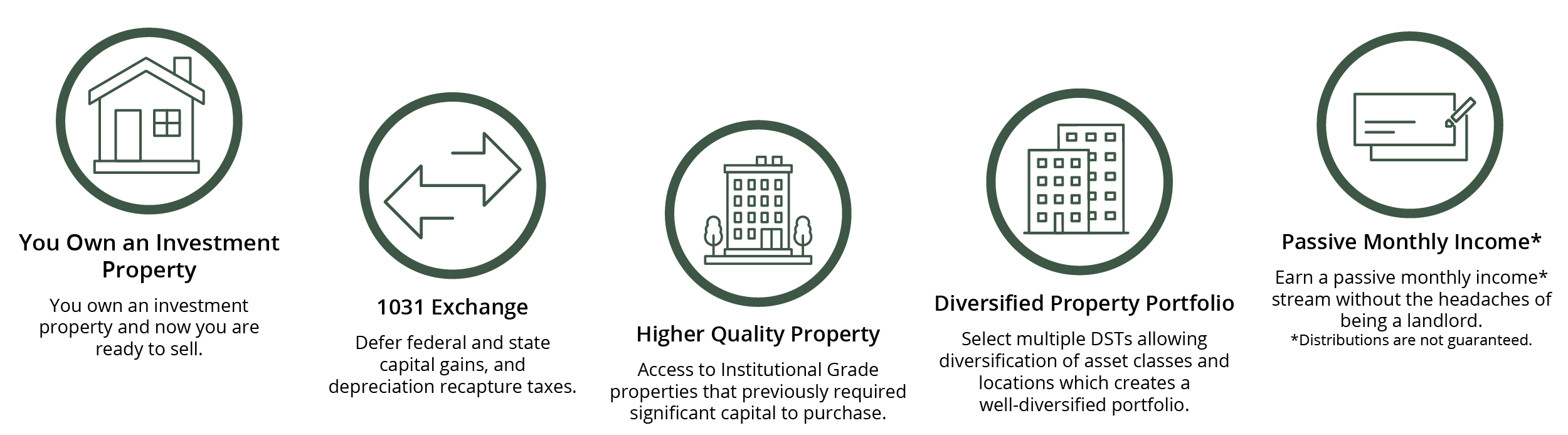

A Delaware Statutory Trust (DST) is a legal entity created as a real estate trust under Delaware law. The DST is the owner of the property or properties and holds title and deed to the investment property. A DST is an alternative 1031 Exchange investment structure that meets the requirements of a qualified replacement property interest under 1031 Exchange rules.

Categories of Offerings

Hover over the categories below to learn more.

Categories of Offerings

Tap on the categories below to learn more.

Retail

Retail

Retail property types are properties used to market and sell consumer goods and services. This category includes single tenant retail buildings, small neighborhood shopping centers, large shopping centers with grocery store anchor tenants, and “power centers” with large anchor stores.

Student Housing

Student Housing

Student housing is a specific type of housing that is designed for students and can come in a variety of forms including on-campus dormitories, off-campus dormitories, student apartments and student co-ops. It can be a convenient and social option for students.

Multi-Family

Multi-Family

A multi-family property is any residential property that contains more than one housing unit. Duplexes, townhomes, apartment complexes and condominiums are common examples of multi-family properties.

Hospitality

Hospitality

Hospitality real estate usually refers to properties primarily in the service sector such as hotels, resorts, conference centers, and other lodging facilities.

Industrial

Industrial

Industrial real estate typically involves properties where goods are made, stored and/or shipped. It tends to fall under three categories: manufacturing, storage and distribution, and flex space. It is a critical component of the global supply chain that keeps the world’s goods moving from makers to markets.

Medical Office

Medical Office

Medical office buildings are real estate assets dedicated to the medical field and used for medical purposes. This includes healthcare practices for various providers such as dentists, doctors, and other clinicians.

Self-Storage

Self-Storage

Self-Storage real estate focuses on properties where individuals and businesses can rent space or units to store their belongings, ranging from household items to business inventory. Usually rented on a month-to-month basis, these facilities can range from small, local establishments to large, multi-story complexes in urban areas.

Senior Housing

Senior Housing

Senior housing can take many forms, from independent living 55+ communities to assisted living and skilled nursing care. Most senior housing facilities also offer a variety of social and recreational activities to help residents stay active and engaged. Many also offer full or part-time medical care to help seniors stay healthy in their golden years.

Benefits

DIVERSIFICATION

Investors can select multiple DST properties as part of their 1031 Exchange allowing diversification of asset classes, locations and access to high-quality properties.

LOWER MINIMUM INVESTMENTS

1031 Exchange DSTs have lower minimum investments, often as low as $100,000 of equity. Some DST Sponsors may allow a lower minimum in certain circumstances.

PREDICTABLE PROPERTY CLOSINGS

The 45-day identification period can be stressful and risky for many 1031 Exchange investors. The competition for quality individual replacement properties can be fierce and can result in bidding wars with failed purchases. Purchasing a DST can be a simpler and quicker process in completing a 1031 Exchange.

DEFER CAPITAL GAINS

DST investors can defer federal and state capital gains, and depreciation recapture taxes.

PASSIVE INCOME

DST investors can enjoy passive income* without the active day-to-day property management obligations.

*Distributions are not guaranteed.

PROFESSIONAL THIRD-PARTY PROPERTY MANAGEMENT

The DST Sponsor takes on the property management duties until the property is sold. While the DST owns the property, each investor owns a proportional interest in the DST.

Risks

INVESTORS DO NOT HOLD TITLE

1031 Exchange DST investors do not hold title of the property but rather own beneficial interests in the trust and the sponsor controls the management and selling of the property.

ILLIQUIDITY

A Delaware Statutory Trust interest is an illiquid alternative investment and there is no current active secondary market for selling your interest, which creates the inability to access immediate liquidity.

POTENTIAL FOR PROPERTY VALUE LOSS

All real estate investments have the potential to lose value during the life of the investment.

REDUCTION OR ELIMINATION OF MONTHLY CASH FLOW DISTRIBUTIONS

Like any investment in real estate, if a property unexpectedly loses tenants or sustains substantial damage, there is a potential for suspension of cash flow distributions.

NO PERFORMANCE GUARANTEE

General real estate market risks also apply to DSTs. There can be no assurance that a property will perform as projected. DSTs are subject to economic volatility, tenants not paying their rent on time, and other traditional risks of owning, operating and selling real estate.

POTENTIAL CHANGE IN TAX LAW

Tax laws are subject to change, which may have a negative impact on a DST investment.

1031 Exchange and DST Purchase Process

One Month Before Closing

Call or email Bernardo Asset Management (BAM) well ahead of your proposed relinquished property closing date so we can begin to research and identify potential Delaware Statutory Trusts. Select and assign a Qualified Intermediary (QI) to receive the sales proceeds from your title company.

Day Of Closing

Notify BAM that you have closed on your relinquished property. Do not take personal receipt of the funds at closing or your exchange will be invalidated. Follow up the next day with your title company to assure funds are wired to your Qualified Intermediary (QI). Review DSTs that are currently available in the BAM Replacement Property Inventory Report.

45 Day Identification Period

There is currently a significant upswing in 1031 Exchange activity and in the purchase of DSTs. More attractive DST offerings can sell out quickly, so it's important to alert BAM early on and let us know you have made a decision to purchase a DST. Please identify the DST offerings available from BAM that you want to invest in to complete your 1031 Exchange.

DST Closing

Most investors prefer to have a closing on their DST replacement property purchase sooner rather than later, so they can begin earning income as soon as possible. During this period, Broker/Dealer and DST Sponsor paperwork is completed and forwarded by BAM for review and approval to our Broker/Dealer and the DST Sponsor. Upon approval, funds are wired from your Qualified Intermediary (QI) to the DST Sponsor. Generally, your DST closing occurs within five business days.

1031 Exchange Replacement Property Inventory Report

Send it to me!

Frequently Asked Questions

What IS AN ACCREDITED INVESTOR?

An accredited investor is an individual with a net worth of at least $1,000,000 (excluding the equity in your primary residence) or has income for the last two years of $200,000 or greater ($300,000 if joint income with spouse), with an expectation of equal or greater income in the current year.

WHAT DOES MY OWNERSHIP LOOK LIKE IN A DST?

Upon purchase of a DST, an investor will receive a beneficial interest in the Trust, which is considered a qualified replacement property interest. All owners receive a proportional interest in the income and expenses of the DST, including depreciation and interest expense deductions.

HOW LONG IS THE TYPICAL HOLD PERIOD FOR A DST INVESTMENT?

DST investments are designed to be long-term investments, with holding periods usually ranging from 5-10 years. DST investors are often looking for a stable, long-term income* stream and may be less focused on short-term capital appreciation. It is important for investors to carefully review the terms of the DST Private Placement Memorandum (PPM), including the projected holding period before making an investment decision. *Distributions are not guaranteed.

Schedule A Consultation

Think a DST is right for you? I'd be happy to speak with you and determine if a DST is in your best interest.